What is our Air Cargo Pricing Data?

We publish historical General Air Cargo Prices from the TAC Indices. The TAC Indices are rigorously audited by the Baltic Exchange in the UK (founded in 1744), under the authority of the Financial Conduct Authority in the UK. Fully in accordance with the guidelines of the International Organization of Securities Commissions (IOSCO). Our pricing is the 7-day average of pricing between Forwarders and Airlines, based on Actual Weight.

The data itself is derived directly from Actual Transactions from leading freight forwarders. There is no declaratory, or mixed data – all real numbers, from real transactions, which include Spot & Contract & BSA rates.

If you want to know EXACTLY what happened on a specific trade route, over a specific period, in General Air Cargo – you can rest assured that TAC Indices will provide you that information.

The historical data is excellent for trend and seasonality analysis, and to see how markets performed in trying times (wars, inflation, pandemic, etc.)

Subscribers to TAC Index data include some of the largest Fortune 500 companies, Freight Forwarders, Airlines and Financial Institutions in the world.

Air Freight Data is the authorized reseller worldwide of historical archived TAC Index data, and can be downloaded right here on our site.

Analytics

Never before has such timely, high quality and actionable data been available to market users. TAC Index data sets are used for benchmarking, modelling, dynamic price modelling, as a macroeconomic indicator and more. The historical data sets provided herein support all historical analytical analysis on the major air cargo markets.

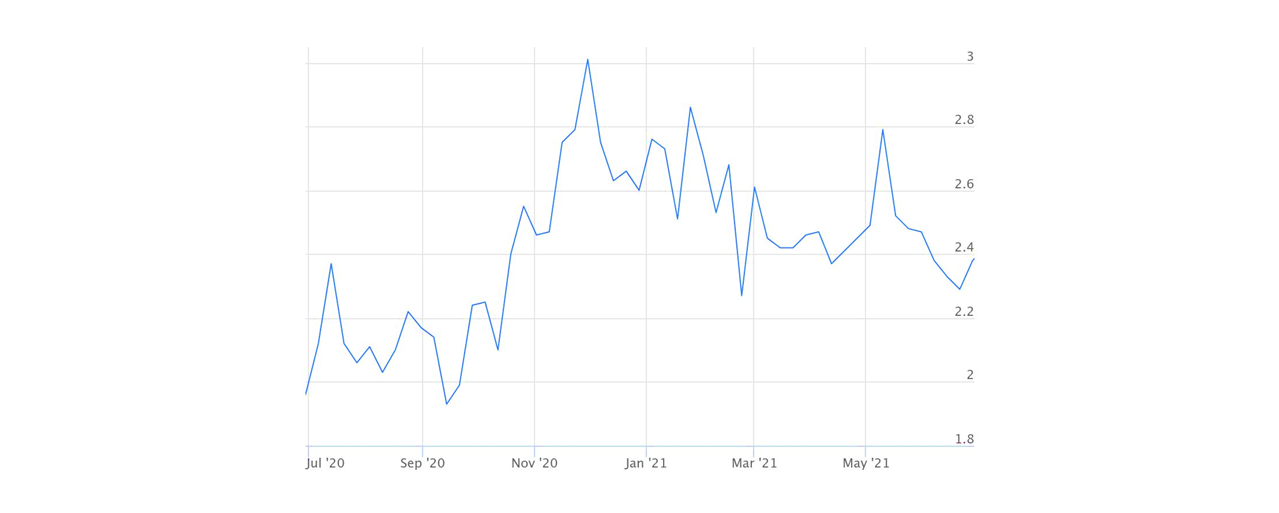

SHANGHAI to CHICAGO

Example visualization of TAC Index historical data. Data supplied as a flat file (csv) only.

Core Users of TAC Index Data

Multiple industries utilize the TAC data sets in different ways. Airlines, Freight Forwarders, Shippers, Logistics Firms, Government Commercial Departments, Academics and Researchers of air cargo can all optimize their assessments through reviewal of TAC Indices historical rate movements.

Global Air Cargo Routes

View all-

Asia Outbound Routes

Outbound general air cargo routes from Asia, week-by-week.

-

Europe Outbound Routes

Europe outbound general air cargo pricing, week-by-week.

-

North America Outbound Routes

North America Outbound Routes